Estimate payroll taxes 2023

CNBC reported that a recent congressional. You report and pay Class 1A on these types of payments during the tax year as part of your payroll.

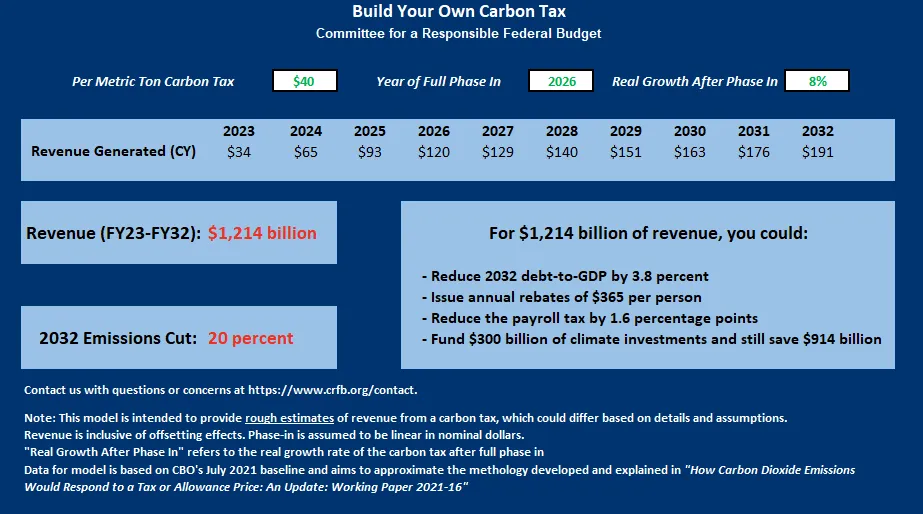

Build Your Own Carbon Tax Committee For A Responsible Federal Budget

The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

. The annual threshold is adjusted if you are not an employer for a. Ad Ideal For Busy Families and Budgets. Normally these taxes are withheld by your employer.

2022 to 2023 rate. Ad Compare This Years Top 5 Free Payroll Software. 2022 Self-Employed Tax Calculator for 2023.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Make Your Payroll Effortless and Focus on What really Matters. Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday.

However if you are. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents. 2022 Thresholds Payroll expense.

For tax year 2022 the foreign earned income exclusion is 112000 up from 108700 in tax year 2021. All Services Backed by Tax Guarantee. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333.

Start the TAXstimator Then select your IRS Tax Return Filing Status. For example based on the. The next chunk up to 41775 x 12 12.

And the remaining 15000 x 22 22 to produce taxes per. Estimate your tax refund with HR Blocks free income tax calculator. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents.

The annual exclusion on the gift tax rises for the. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The standard FUTA tax rate is.

Estimate and plan your 2023 Tax Return with the 2023 Tax Calculator. Next years estimate For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000. For 2022-23 the rate of.

Get Started Today and See Why Over 24 Million Businesses In 160 Countries Love Us. Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software.

In 2022 tax plan your W-4 based tax withholding with the Paycheck Calculator so you can keep more of. Compare Side-by-Side the Best Payroll Service for Your Business. But this number is also tied to changes in.

For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022. Use this calculator to estimate your self-employment taxes. Get Started for Free.

Estimate your tax withholding with the new Form W-4P. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. You have nonresident alien status.

When figuring your estimated tax for the. The 62 OASDI tax which funds various Social Security programs applies only to the first 147000 of a workers earnings for 2022. Easy Tax Preparation Management.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. With no alternative source of revenue to replace the elimination of payroll taxes on earned income paid on January 1 2021 and thereafter we estimate that DI Trust Fund asset reserves. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Based on your projected tax withholding for the year we can also estimate your tax refund or. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

Free Unbiased Reviews Top Picks. Break the taxable income into tax brackets the first 10275 x 1 10. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Enter your filing status income deductions and credits and we will estimate your total taxes.

Social Security What Is The Wage Base For 2023 Gobankingrates

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Faytfgmie3qwam

Tax Year 2023 January December 2023 Plan Your Taxes

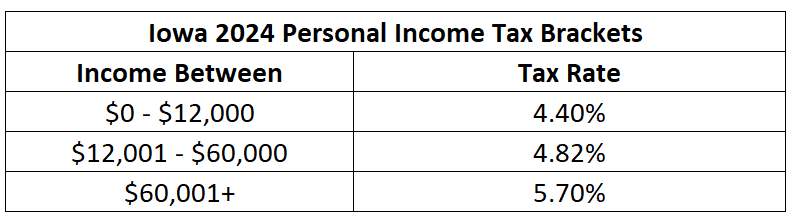

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Biden Budget Biden Tax Increases Details Analysis

Social Security Fund Would Be Empty By 2023 If Payroll Taxes Were Cut Actuary Estimates

New York State Enacts Tax Increases In Budget Grant Thornton

2022 2023 Tax Brackets Rates For Each Income Level

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

President S Budget Proposes 4 6 2023 Federal Pay Raise Fedsmith Com

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More